Whether you drive a car, motorcycle, commercial truck, or engage in rideshare driving, it is important to understand Ohio’s auto insurance requirements. This guide is intended to inform you about Ohio’s insurance landscape, ensuring you are fully compliant and adequately protected. Auto insurance is legally required in Ohio, so it is imperative that you have the right coverage for your specific needs.

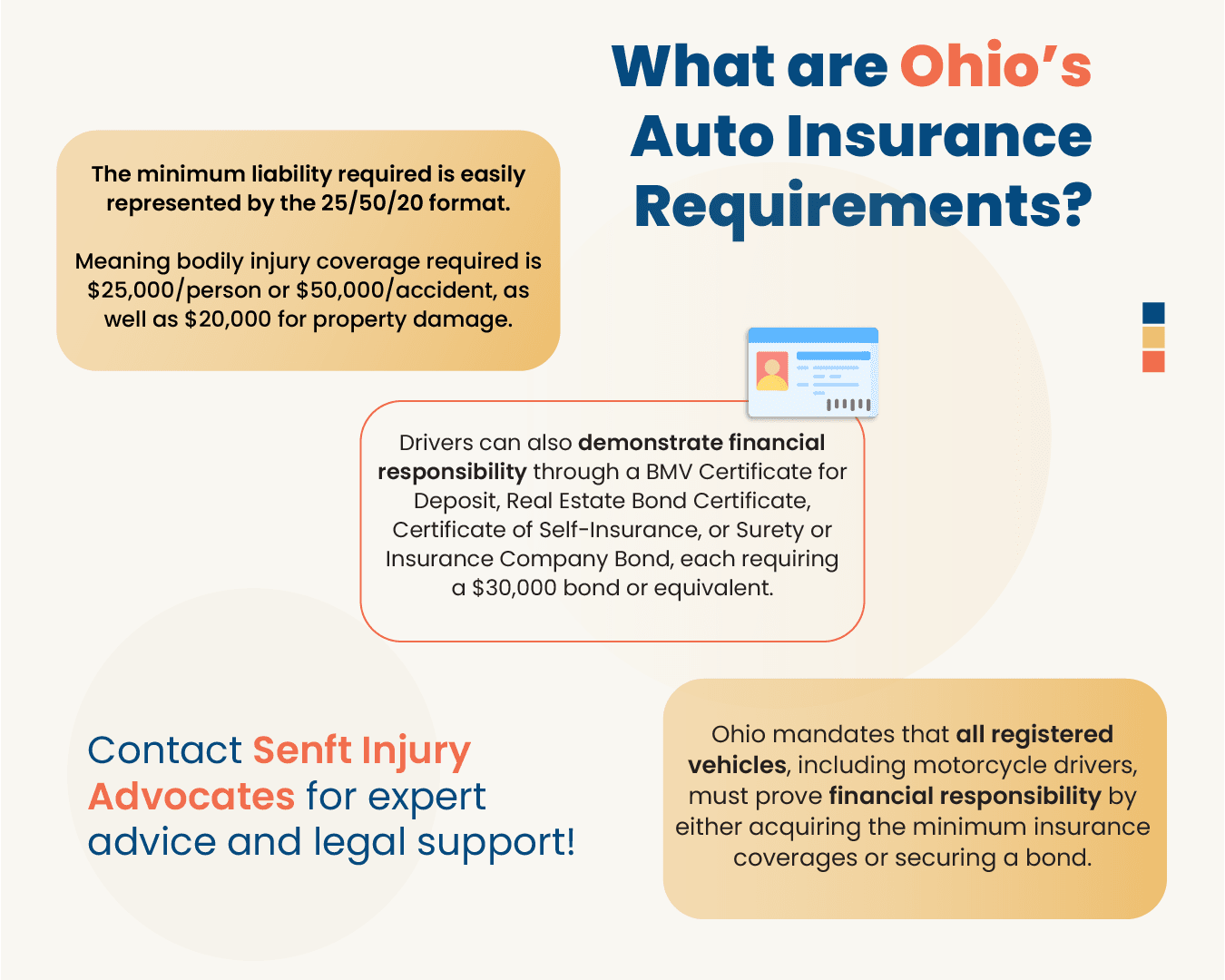

In Ohio, adhering to the state’s Financial Responsibility (FR) laws is non-negotiable. It is illegal to drive any motor vehicle without insurance or other proof of financial responsibility. It is also unlawful for a car owner to let someone else drive their car without proof of insurance. To comply with these FR requirements, a person must either maintain insurance or secure a bond. This requirement exists not only to protect you, but also other road users in case of an accident. The minimum liability auto insurance requirements in Ohio are:

While Personal Injury Protection (PIP) is not mandated by Ohio law, it is highly recommended. PIP can help pay for medical bills, lost wages, and other costs after an accident, regardless of fault. Securing extra coverage can safeguard you and your assets in the unfortunate case of a severe accident. Insufficient coverage may permit the affected party to claim your assets to compensate for any damage incurred, as per legal allowances.

Ohio law offers alternatives to traditional auto insurance, allowing motorists to demonstrate financial responsibility in several ways:

While uninsured motorist coverage is not a mandated requirement for motorcycles in Ohio, it is strongly recommended. This specific coverage protects you in the event of an accident with a driver who either lacks insurance or is underinsured. It ensures that medical costs, lost wages, and other damages are covered without the need to directly pursue the at-fault, uninsured driver.

Commercial vehicle drivers in Ohio are subject to rigorous scrutiny under both state and federal regulations. This includes specific mandates from the Federal Motor Carrier Safety Administration (FMCSA), which plays a pivotal role in overseeing transportation across the United States. Here’s an in-depth look at the key requirements for commercial truck insurance in Ohio:

Ohio requires different minimum liability coverage when operating across state lines depending on the commercial vehicle.

Motorcycle enthusiasts must adhere to the same liability insurance minimums as auto vehicles in Ohio. Thus, motorcycle insurance must include:

Ensuring you have the proper coverage is not just about compliance; it’s about your safety and financial security.

Rideshare drivers operate under unique conditions, toggling between personal vehicle use and commercial operation. Ohio law, under Section 3942.02, requires rideshare drivers to maintain the following minimum coverage:

These requirements aim to fill the insurance gaps that may occur during the different phases of rideshare driving. Personal injury protection and uninsured motorist coverage are not required in Ohio but strongly recommended.

Vehicle Type | Insurance Type | Minimum Coverage |

Auto | Bodily Injury Liability | $25,000 per person, $50,000 per accident (2+ persons) |

| Property Damage Liability | $25,000 per accident |

Motorcycle | Bodily Injury Liability | $25,000 per person, $50,000 per accident (2+ persons) |

| Property Damage Liability | $25,000 per accident |

Truck | Commercial Auto Liability (Intrastate) | General freight at least $75,000 |

|

| Household goods carriers at least $300,000 |

|

| Cargo vans & sprinters at least $300,000 |

Rideshare | Insurance When Not Engaged in a Ride (App On) | Bodily injury: $50,000 per person, $100,000 per accident (2+ persons) | Property damage: $25,000 per accident |

| Insurance When Engaged in a Ride | Combined single limit of $1,000,000 |

Understanding and navigating through Ohio’s auto insurance requirements can be overwhelming. Senft Injury Advocates specializes in providing comprehensive legal advice and representation tailored to the unique needs of Ohio drivers. With a commitment to safeguarding your rights and financial well-being, we offer a free initial consultation to help you understand your insurance obligations and navigate potential claims.

Whether you’re a personal vehicle owner, motorcycle rider, commercial driver, or rideshare operator, having the right insurance coverage is crucial. Contact Senft Injury Advocates today for expert support in navigating Ohio’s auto insurance requirements confidently.

Ohio Revised Code Chapter 4509

Ohio Revised Code Chapter 3942

Ohio Department of Insurance, Auto Insurance Minimum Coverage Requirements