07/15/24

15 min

At Fault vs. No-Fault Systems: Coverage, Claims, and Compensation

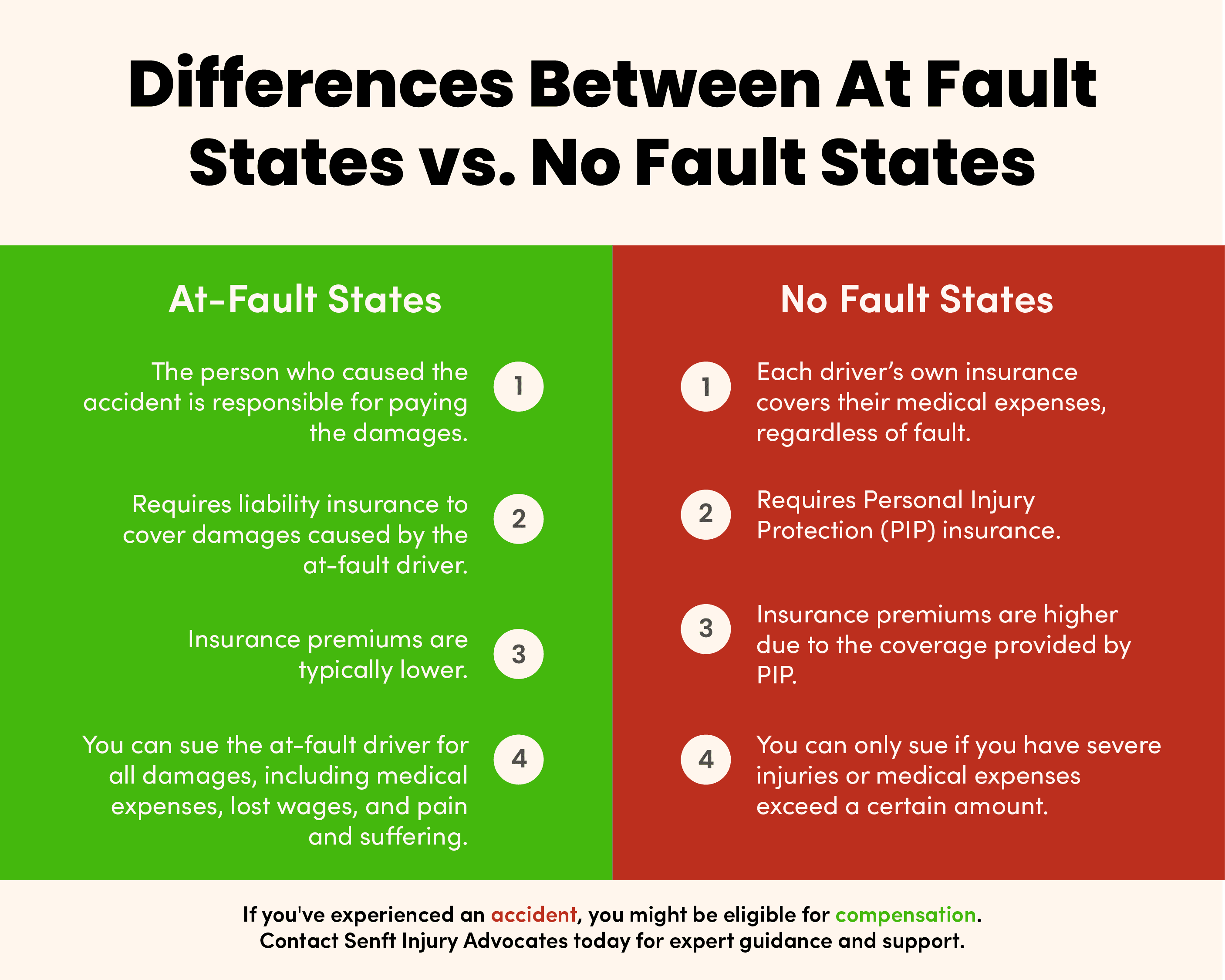

Understanding the intricacies of auto insurance policies and at fault vs. no-fault systems is crucial if you’ve been involved in a car accident. In most states, the driver at fault is responsible for damages, but some states operate under a no-fault system. This means that regardless of fault, each driver turns to their insurance provider to cover medical expenses. However, if certain criteria are met, victims can still pursue legal action.

In no-fault states, drivers must have personal injury protection (PIP) insurance. PIP generally covers medical expenses, lost earnings, and other non-reimbursed costs, regardless of fault. Typically, premiums are higher due to the personal injury protection component required by no-fault laws. Most states follow the standard tort (at fault) system; however, these twelve states fall under the no-fault system:

A person in an accident may still be able to file a claim against an at-fault party, even under a no-fault system. No-fault auto insurance states use either a verbal or monetary threshold to determine exceptions for suing in auto accidents, affecting how damages and injury claims are managed.

This system is in place in states like Florida, Michigan, New Jersey, New York, and Pennsylvania. It restricts lawsuits for non-economic damages unless injuries are deemed serious, such as significant disfigurement or death. The definition of a “serious injury” can vary by state. It generally includes conditions like severe disfigurement, broken bones, or permanent loss of a vital bodily function.

Seven no-fault states, including Hawaii, Kansas, Kentucky, Massachusetts, Minnesota, North Dakota, and Utah, use a monetary threshold. Lawsuits for non-economic injuries are only permitted if medical expenses exceed a certain dollar amount.

New Jersey, Pennsylvania, and Kentucky offer a “choice” no-fault system. Motorists in these states can opt between a no-fault auto insurance policy with either a verbal or monetary threshold and a traditional tort liability policy. This choice influences how and when tort claims can be pursued following an auto accident. It provides flexibility, thereby potentially affecting the strategy for legal and financial recovery after an accident.

When it comes to at-fault accidents, the person who caused the accident is responsible for paying the damages. However, insurance premiums in these states tend to be lower on average compared to no-fault states. In states that assign fault for auto accidents, drivers get liability insurance to avoid out-of-pocket costs for damages caused by crashes they’re responsible for. This setup ensures that the insurance of the driver at fault covers damages from the incident. Fault determination affects insurance payouts and premiums, with specific negligence laws influencing compensation eligibility based on the claimant’s fault level.

Understanding the distinctions between different negligence systems is crucial. These concepts directly impact how fault is determined and what compensation an injured party might receive. Here’s a quick breakdown of the most common types:

Every party involved in an accident can collect damages, but the amount is reduced by their percentage of fault. For instance, if a person is found to be 10% at fault in an accident, they can still recover compensation. However, the amount would be reduced by 10%.

This model is similar to pure comparative negligence, but with a key restriction. Parties can only recover damages if their fault is below a certain percentage, typically 50% or 51%. This means a person who is more than 50% or 51% at fault (depending on the state) for an accident cannot recover any damages from other at-fault parties.

Contributory negligence is one of the strictest forms of negligence law. If the injured party is found to be at all responsible for the accident, even just 1% at fault, they cannot recover any damages.

Negligence Type | Description | State(s) |

Pure Comparative Negligence | You can recover compensation from the at-fault party even if you are 99% at fault. The amount you recover is reduced by your percentage of fault. | Alaska, Arizona, California, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, New York, Rhode Island, Washington |

Modified Comparative Negligence | You can only recover compensation from the other party if you are less than 50% at fault, or 51% in some cases. If you hold any fault when seeking compensation, your compensation may be reduced by your percentage of fault. For example, if the court awarded you $110,000 dollars, but you are found 30% at fault, you would only receive $77,000 — 30% less than the total amount. | Arkansas, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, Massachusetts, Michigan, Minnesota, Montana, Nebraska, Nevada, New Hampshire, New Jersey, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Vermont, West Virginia, Wisconsin, Wyoming |

Slight / Gross Comparative Negligence | In South Dakota, negligence may be considered either “slight” (minor) or “gross” (excessive). To recover compensation, the other person’s negligence must be considered “gross.” In addition, you must either not be found negligent, or your negligence must be “slight.” | |

Contributory Negligence | You cannot recover compensation if you hold even 1% of fault. |

Understanding fault revolves around the legal notion of negligence, which mandates that every road user must act in a manner that prevents harm to others. When this expectation is not met, it may constitute negligence. There are a few different types of negligence, each impacting the determination of fault and the subsequent compensation for the injured party. Here’s a simplified breakdown:

Compensatory damages awarded to an accident victim are categorized into two main types: economic and non-economic damages. These categories are crucial in understanding the scope of compensation available in personal injury lawsuits, and their application can vary significantly depending on whether the case is adjudicated within a fault or no-fault insurance system.

Economic damages are typically straightforward to calculate as they are based on actual expenses or losses experienced by the person. Receipts, bills, and employment records serve as documentation to support these claims. These types of damages refer to quantifiable losses resulting from an injury or accident. They cover:

Calculating non-economic damages is more complex, as there’s no direct financial expenditure or loss to reference. The determination often involves considering the severity of the injury, the duration of pain and suffering, and the overall impact on the plaintiff’s quality of life. Non-economic damages are intangible and more subjective, covering:

At Senft Injury Advocates, we understand that navigating the complexities of fault, negligence, and compensation after a car accident can be overwhelming. Whether you’re in a fault or no-fault state, the nuances of insurance policies and legal standards for negligence directly impact your rights and potential compensation. Senft Injury Advocates stands ready to support you in securing the compensation you deserve. With expertise spanning the gamut of auto accident claims, we’re committed to advocating for your rights and recovery every step of the way. Contact us today, and let us advocate for your rights, guide you through the legal process, and work to secure the compensation you deserve.